The Taiwanese healthcare market has gained global recognition in recent years. The universal coverage provided by the National Health Insurance (NHI) programme establishes a robust foundation, and Taiwan's highly skilled healthcare workforce adds to its strengths. Leveraging its ICT and medical device industries, Taiwan emerges as a promising market for smart healthcare product development.

Taiwan’s healthcare system receives high appraisal, but it also comes at a high cost

Basking in 91 per cent public satisfaction, Taiwan's healthcare system extends its influence globally. At the core lies the NHI program, covering 99.9 per cent of its 23 million citizens. Additionally, 93 per cent of healthcare providers are contracted with the NHI, both public and private. This network ensures more than mere access; it provides choices for those seeking top-notch medical care.

A central element of Taiwan's National Health Insurance (NHI) system is the global budget payment model. Under this model, the annual global budget for health insurance expenditure is allocated in advance based on the volume of medical services and a cost growth limited to five percent. This way, healthcare providers receive a fixed amount of funding, which is intended to control costs and encourage efficient use of resources. It is particularly efficient as a cost-limiting measure in markets with lower levels of competition.

However, this approach also poses challenges. It can put financial pressure on healthcare providers, as reimbursement rates are tightly controlled. The bi-yearly review of prices and volumes of services adds another layer of complexity, potentially leading to lower or no reimbursements for new, innovative treatments or medical devices.

However, compared to other developed markets such as South Korea and Sweden, Taiwan’s National Health Expenditure (NHE) is notably lower. In 2021, Taiwan allocated 6.6 per cent of its GDP to healthcare, in comparison to Sweden and South Korea’s 11.4 per cent and 8.8 per cent respectively.

This delicate dance between financial sustainability and medical innovation underscores the complexity of Taiwan's healthcare landscape.

Declining number of medical professionals a concern for patients and the government

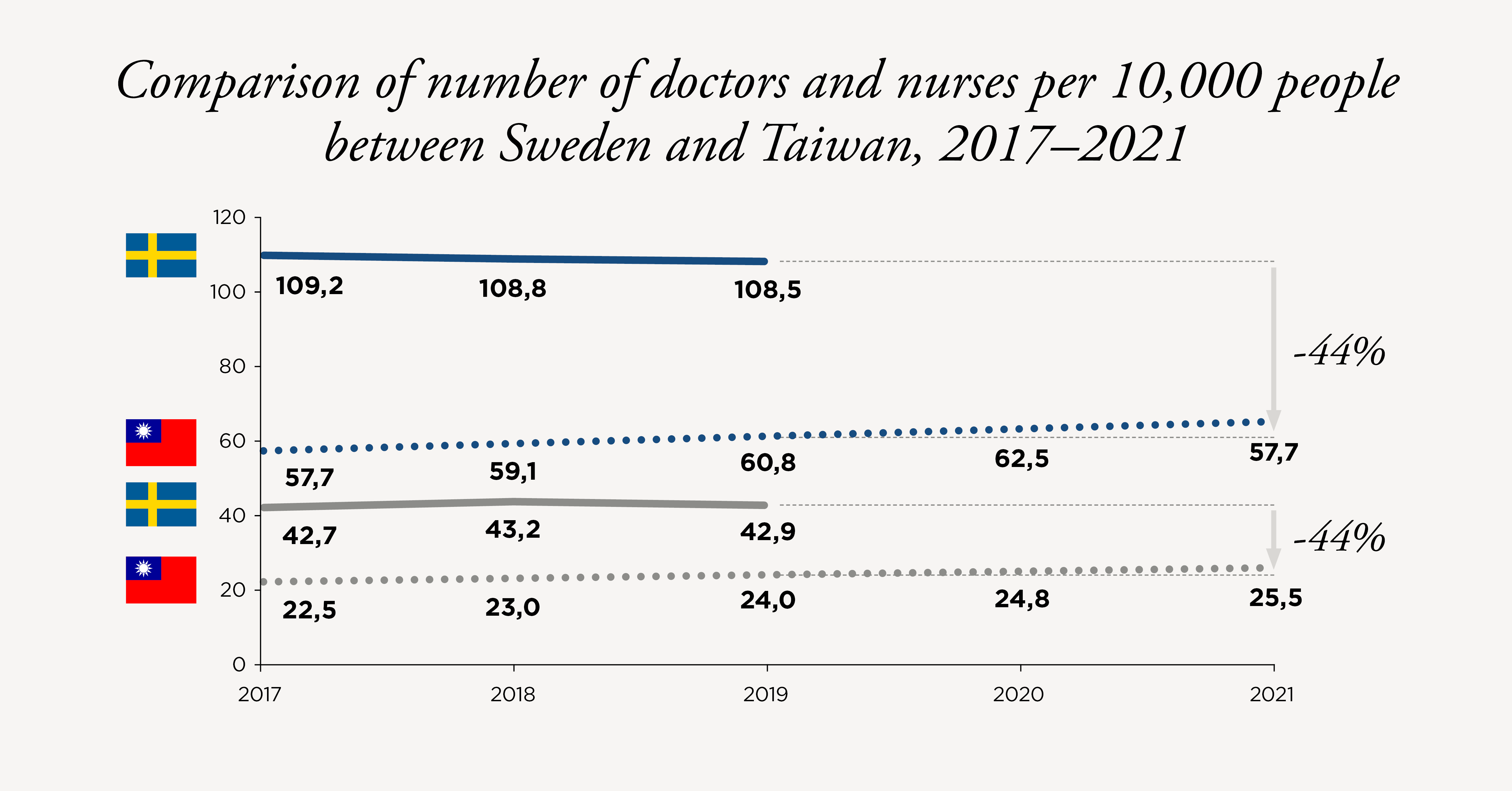

In contrast to Sweden, Taiwan faces a significant shortage of medical professionals—only 64.5 nurses and 25.5 doctors per 10,000 capita, a 44 per cent deficit. This scarcity is driven by factors such as capped reimbursement levels in the NHI scheme, governmental quotas on medical personnel, high turnover rates due to long hours and stress, especially during the pandemic, and a lower rate of nursing graduates.

To counter this, the Taiwanese government is actively addressing workforce challenges. Initiatives include improving employment policies to safeguard worker rights, revising the NHI scheme to balance expenses, and leveraging digitalisation to enhance medical efficiency. These steps aim to fortify the healthcare workforce and create a resilient system capable of meeting the evolving needs of the population.

Digitalisation key to keeping Taiwan’s healthcare system secure and efficient

Taiwan's healthcare system is highly digitalised, featuring an IC-embedded NHI smart card that stores and tracks medical history. The national health insurance administration (NHIA) maintains high NHI contracted rates with medical institutions, providing easy access to the national medical data network.

The NHI's MediCloud System is a cloud-based data-sharing platform that prevents duplications, reducing waste, and enhancing the quality of medical care services. The My Health Bank initiative allows patients access to their electronic medical records for self-management. Since 2019, the NHIA has released de-identified NHI databases, facilitating advancements in medical technologies such as cloud computing, big data, and AI.

Taiwan's advanced healthcare system drives demand for new technologies, particularly in digital solutions and smart healthcare. Initiatives like Medi-Cloud aim to reduce inefficiencies, and the NHI's openness to data sharing fosters collaboration opportunities.

The government is continuing to emphasise the importance of digital solutions to expand healthcare access. In 2023, TWD 300 million has been allocated for a one-year expanded telemedicine trial programme that is starting in the first quarter of 2024. The current telemedicine service caters to active daily living (ADL) patients in 64 townships and villages but covers only 17 per cent of Taiwan's total. Under the new plan, it will extend to more ADL patients in different cities and counties, offering expanded healthcare access.

Demand for imported and high-end medical devices is high

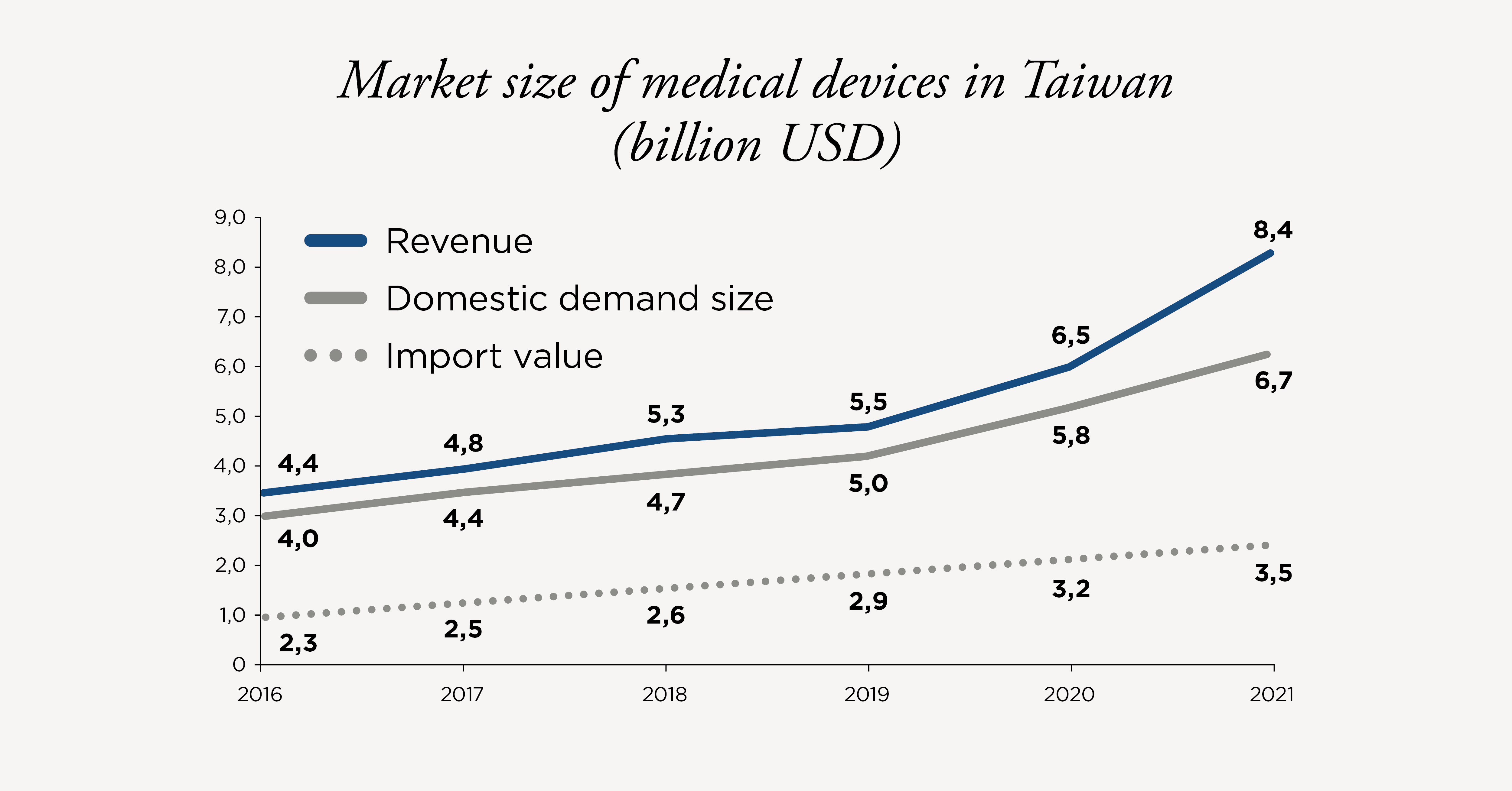

Taiwan relies on 70 per cent imported high-end medical devices, including 55 per cent of orthopedic implants. The local medical device industry focuses on low to middle-end devices, projecting a seven per cent CAGR between 2021-2026, creating several opportunities for collaboration. As Taiwan's medical device market grows with a robust seven per cent CAGR, Swedish companies can explore high-end devices in imaging and orthopaedic implants, contributing to Taiwan's healthcare evolution. Challenges include intricate product registration, which takes about a year for Class II products. Opportunities arise from the 2019 separation of the Medical Device Act which has led to the streamlining of processes.

Several opportunities for Swedish healthcare companies

Are you considering Taiwan as the next step in your expansion journey? We have identified key challenges and opportunities to consider when entering the Taiwanese healthcare market.

- The robust digital healthcare infrastructure in Taiwan, coupled with the recent advancements in telemedicine, are fuelling a growing need for innovative digital solutions and smart healthcare technologies.

- There is a greater need for advanced medical devices and innovative pharmaceuticals, particularly in areas such as imaging, orthopaedic implants, cancer treatment, and chronic disease management and long-term care. Swedish companies are well-positioned to significantly contribute to enhancing Taiwan's healthcare landscape in these critical areas.

- Initiatives like Medi-Cloud and the NHI's openness to data sharing create opportunities for collaboration between Swedish companies and Taiwanese healthcare entities. This can foster partnerships in research, development, and technological integration.

- The intricate product registration process, taking about a year for Class II products, can be a hurdle for foreign companies. Understanding and navigating this regulatory landscape is crucial for a successful market entry.

Business Sweden can connect you with local business opportunities

Business Sweden has been conducting partner searches and market introductions in Taiwan since the early 1990s and we have a broad understanding of the general market as well as of the healthcare sector. We are more than happy to assist you and your company with market information and strategic consultation to ensure an effortless and successful market entry.